Industry News

TGI Fridays Bankruptcy: The casual dining chain filed for Chapter 11 bankruptcy protection, citing declining sales and increased operational challenges. Nearly 100 locations closed in 2024. (AP News)

Red Lobster’s Restructuring: The seafood chain exited bankruptcy after a court-approved plan, supported by $60 million from Fortress Investment Group. Under new CEO Damola Adamolekun, the company aims to streamline operations, improve menu offerings, and enhance employee engagement while operating 20% fewer locations. (Inc.com)

Price Fluctuations

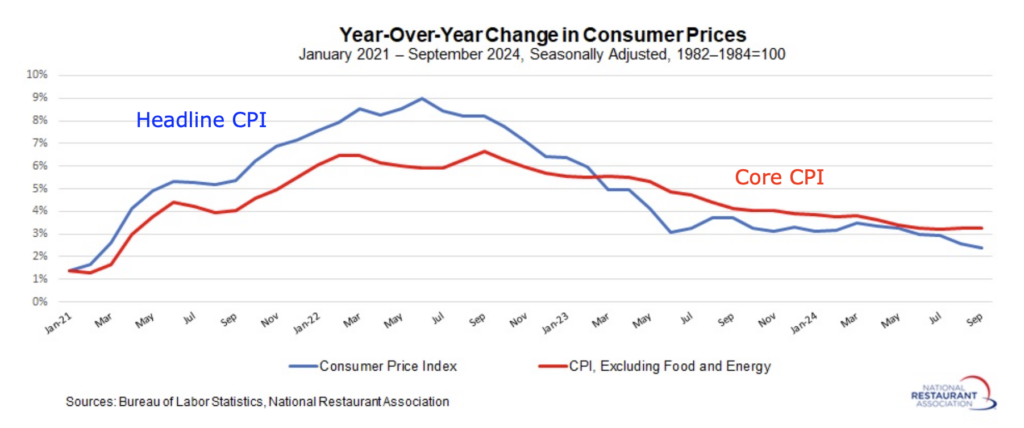

Headline inflation has shown signs of a significant slowdown in price increases, but core inflation remains high | Image Source NRA

According to National Restaurant Association (NRA) Research And Media Report for October 2024, from September 2023 to September 2024, Headline CPI (includes food and energy) has risen 2.4%, down from 2.6% in August, representing the slowest year-over-year pace since February 2021.

Core inflation, which doesn’t include food and energy prices, went up by 0.3% for the second consecutive month, slightly more than expected. Key costs like transportation services (+1.4%), clothing (+1.1%), and medical care services (+0.7%) saw notable increases. Over the past year, core inflation stayed at 3.3%, the same as August and just slightly above July’s 3.2%, which was the lowest in over two years.

What Food Operators Should Expect: NRA further noted that Inflation shows a mixed picture for restaurants. While overall price increases (including food and energy) have slowed significantly over the past two years, core costs like labor, transportation, and services remain stubbornly high and haven’t improved much in the past four months. The Federal Reserve plans to gradually lower interest rates over the next two meetings in November and December, following a larger cut in September. This approach aims to ease economic pressures without causing a downturn, but since core inflation is still above their target, any relief for businesses may take time. For restaurants, this means ongoing challenges with persistent labor and service costs, even as overall price pressures ease. (National Restaurant Association)

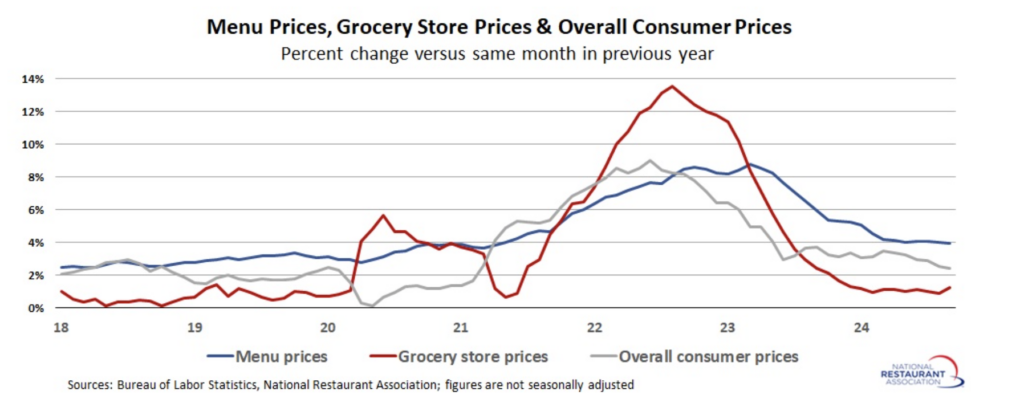

Inflation for both grocery and restaurant prices is easing, but it remains a challenge | Image Source NRA

Menu prices for restaurants rose 0.3% in September, with full-service restaurants seeing a 0.4% increase, their fastest monthly gain since May, while limited-service restaurants rose 0.2%. Year-over-year, menu inflation has slowed significantly, with full-service prices up 3.9% and limited-service prices up 4.1%, both much lower than their peaks in 2022 and 2023. Grocery prices also rose 0.4% in September, showing slower growth compared to the past two years.

What Food Operators Should Expect: Restaurant owners can expect modest menu price increases to continue, with headline inflation slowing but still influenced by labor and service costs. Slower grocery price growth may affect dining demand, so adjust prices carefully to stay competitive.

Average wholesale food prices continued to trend higher in September: With the Producer Price Index for All Foods increasing by 0.8% between August and September. This marked the fourth consecutive monthly gain and the seventh increase in the last eight months. (National Restaurant Association)

Labor Costs: Rising labor costs remain a significant challenge for operators. The implementation of California’s Food Accountability and Standards Recovery Act (FAST Act) on April 1, 2024, mandated a $20 per hour minimum wage for fast-food workers, leading larger brands to raise their menu prices to combat increased labor costs. (Kroll)

Product Demand And Marketing Trends

Simpler Menus on the Rise: Many restaurants are ditching pricey tasting menus for à la carte options, catering to cost-conscious diners. Olo Inc.’s partnership with ezCater automates catering menu updates, helping restaurants streamline operations and reduce costs. Chili’s Grill & Bar has also simplified its menu, focusing on core items to maintain sales and improve efficiency.

Upcoming Holiday Season

According to an article by US Foods, restaurants can boost traffic by marketing early, focusing on popular dishes, and offering catering options. Simplified menu items, festive decorations, and take-home treats are key strategies. Engaging with hotels, promoting day events, and providing gift card incentives can also help increase revenue.

Rewards Network states Restaurants can capitalize on Black Friday by offering enticing entrée specials and holiday-themed drinks to attract tired shoppers. Preparing staff well and promoting gift cards are also key tactics to boost sales. Social media marketing, including posting about specials and hours, can help capture the attention of Black Friday shoppers looking for a break from retail.